Float Cash Flow

Über Float Cash Flow

Float Cash Flow Preis

Float Cash Flow bietet keine Gratisversion, aber eine kostenlose Testversion. Die kostenpflichtige Version von Float Cash Flow ist ab 69,00 $/Monat verfügbar.

Alternativen für Float Cash Flow

Alle Bewertungen zu Float Cash Flow Filter anwenden

Nutzerbewertungen zu Float Cash Flow durchsuchen

Alle Bewertungen zu Float Cash Flow Filter anwenden

- Branche: Computer-Software

- Unternehmensgröße: 51–200 Mitarbeiter

- Wöchentlich für 6-12 Monate genutzt

-

Quelle der Bewertung

Great tool for simple cash flow management, and even better to get rid of manual Excel...

Better cash flow overview, minimizes the need for Excel.

Vorteile

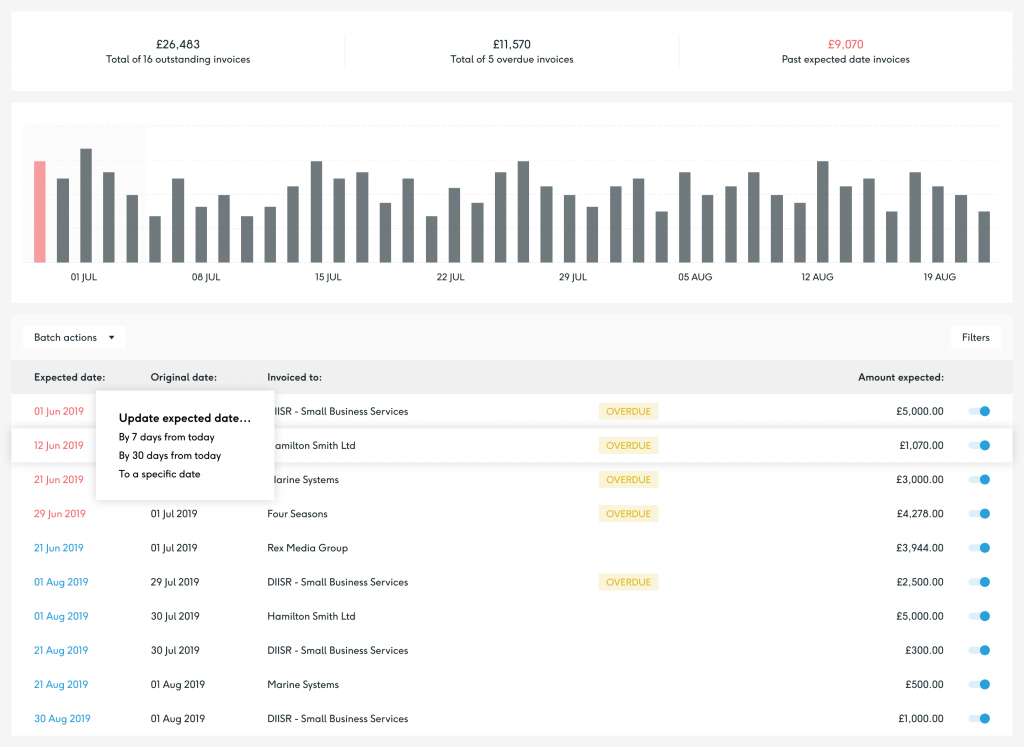

Float easily integrates with Xero, allows you to easily configure which banks get synced for display purposes, and provides excellent insight into the sources of cash and also where cash is being spent.

The invoices due and bills to pay reports are an easy way to access overdue bills and invoices without clicking through the accounting system.

This is ideal for anyone who wants to get an idea of their cash flow history and projections.

Nachteile

The product would be infinitely better if it supported multi-currency accounts, especially with more businesses holding more than 1 currency. Currently, details on cash is based on GL accounts. It might be way more usable if it gave us the option to view this from a customer/vendor name perspective, since we plan our cash flow on that basis, rather than by the GL account.

The concept with this program is so excellent, and I am holding out on new features being released that totally eliminate the need for other products (such as Excel) for tracking and projecting cash flow. If Float can make that leap, it'll easily be the #1 cash flow app.

- Branche: Buchhaltung

- Unternehmensgröße: 51–200 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Crucial cash flow forecasting

I love using Float and everyone at Float is super helpful and friendly. I recommend this app everytime someone requests a cash flow as it's by far the easiest system to use and efficiently procude a cash flow forecast under pressure.

Vorteile

Float is so easy to use for us, but also for our client. It helps our clients keep on track of their cash flow forecasting easier than before as it's so easy to understand whilst being very granular.

Nachteile

If it could go beyond and produce projected profit and loss and balance sheet.

- Branche: Fluggesellschaften/Luftfahrt

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Float is brilliant... but could be better

Float has made the management of cashflow significantly easier and smoother than a spreadsheet!

Vorteile

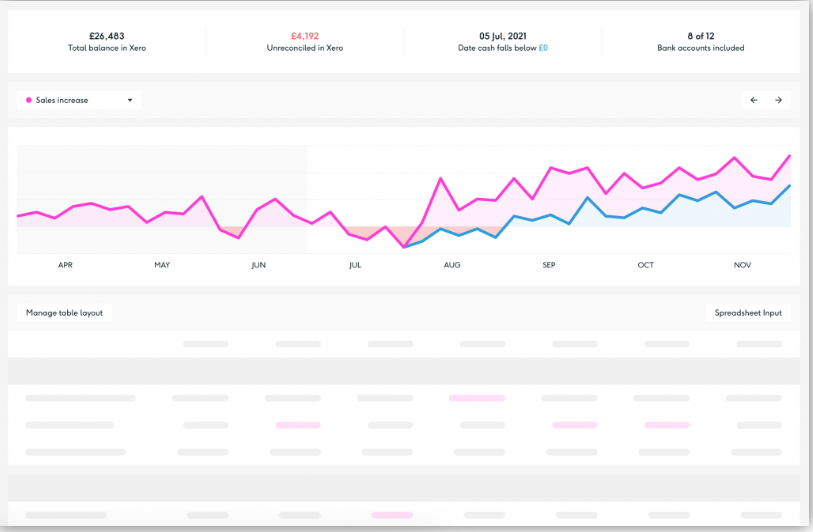

I love how easily Float links in with the other software I use, it also makes looking at different scenarios with comparisons easy.

Nachteile

I think there are some more indepth functions that could be introduced that allow the user to have more control over how the information is displayed.

Such as being able to see purchase orders,

Being able to sort the 'Daily Breakdown' into categories.

Also, it would be really helpful to have a function that shows your current balance less bills that are due, the current display shows the balance at the start of the day with bills that have been paid as still showing due.

- Branche: Buchhaltung

- Unternehmensgröße: Selbstständig

- Wöchentlich für 1-5 Monate genutzt

-

Quelle der Bewertung

Great cash flow forecasting tool!

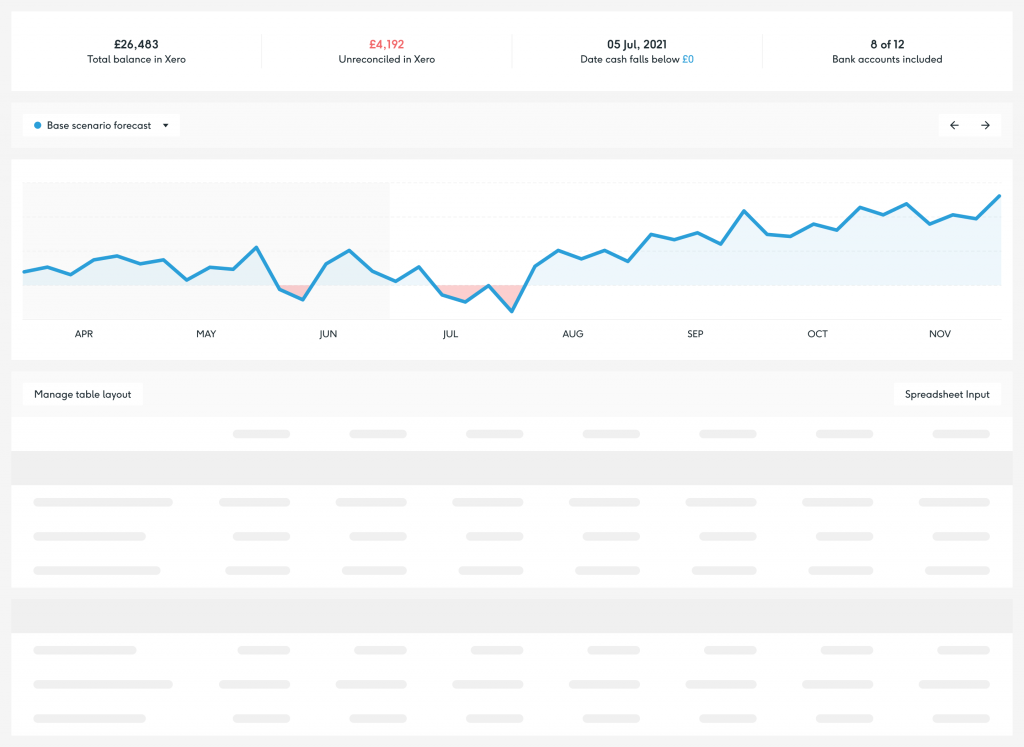

Having an online c/f which links to Xero has enabled me to have c/f conversations real-time with clients and run multiple scenarios. It has eliminated the need for excel s/s which in turn has made my time more efficient. It has increased client engagement and provided me with more time for data analysis rather than s/s checking and data entry.

Vorteile

Option of manual link-up to Xero so forecast can reflect Xero updates immediately.

Ability to run multiple scenarios so clients can see the impact of making different business choices on the cashflow.

Nachteile

It would be useful to be able do s/s upload of scenario budgets - can currently only do for the main forecast I think.

- Branche: Buchhaltung

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Great software, very easy to set up & use, excellent support - could add a couple of features

Vorteile

Super-easy to set up and sync to Xero, and to import or directly input budgets. Easy & really helpful basis to review and amend bill/invoice dates for cashflows.

Scenario planning and comparisons very helpful, and the output from those in charts etc great for presentation. Also allows you move & group cash in/out categories

Nachteile

Other than charts, outputs are limited to CSV files so not that easy/quick to manipulate offline, and have to do all your own formulas & formatting, etc.

I understand they’re working on Excel downloads - soon I hope!

- Branche: Verbraucherdienste

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Great and easy cash flow tool

This tool has helped us to keep on track of our cash flow and took good decisions for the coming months.

Vorteile

I really like integration between Float and Xero accounting tool, updates are reflected immediately. It is easy to use and understand.

Nachteile

Even when you can have different scenarios you just are able to compare against the last month, last 3 months and last 6 months, it would be better if you can select a custom view.

Antwort von The Float Yard

HI Benites, thank you for taking the time to leave a review of Float. We're delighted to hear Float is helping you keep track of your cash flow and make decisions for your business.

- Branche: Marketing & Werbung

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für Kostenlose Testversion genutzt

-

Quelle der Bewertung

Easy way to track workload

Used a trial version for a month to see which task management software would work best for our small marketing team. While Float was easy (and even kinda fun) to implement, its functionality was too limited to continue use. I think it would be most useful in a situation where you have to focus on managing others and gauging the workload and hours spent on each client or project.

Vorteile

Super easy to use and figure out. Took almost no time at all to start implementing it in the workplace. It also makes it really easy to manage others - you can pass tasks from one person to the other, postpone them easily, and see at a glance whether someone is overbooked.

Nachteile

The capabilities are a little limited. While it can help you track workflow and task progression, it doesn't grant you a lot of flexibility in storing info about clients, setting due dates, etc.

- Branche: Architektur & Planung

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Float

Float provides crystal clear visibility on our cashflow. Something we had always struggled with in the past.

Vorteile

Ease of use, clarity of information. Focus.

Nachteile

Nothing in particular.

- Branche: Computer-Software

- Unternehmensgröße: 2–10 Mitarbeiter

- Monatlich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Analyzing my business via Float kept us alive

I run a small business that does large projects. Cash flow and budgeting is paramount to success. Before I found float I was running my business like most folks. Looking backwards to go forward. I was paying myself and employees unsustainable money, not timing expenditures correctly that were needed to grow but could wait. I am still in business and making healthier decisions based on the future numbers because of the insights Float gives me.

Vorteile

The ease of integration with Xero is simple and over the past couple years the software has become easier to configure and setup. Jump in and go!

Nachteile

There is always room for improvement, and the support staff listen. Currently there is nothing that "must" be done besides never stopping the innovation.

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

my experience with float has been little but quite pleasant, since it allows to take control...

Vorteile

what I like the most is its integration with quickbooks and how easy it is to see the arrears with payments to suppliers as well as customer charges, it makes us see that attack immediately and also allows us to see the details of the transactions when we click on a transaction in the cash flow

Nachteile

what I like the least is what it takes updating by giving it the refresh button, I think it's a slow nose if it is for the data handled but I would like it to be faster

- Branche: Fluggesellschaften/Luftfahrt

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Kostenlose Testversion genutzt

-

Quelle der Bewertung

First time using Cash Flow Forecasting

I have never used this type of tool and I am finding it very helpful, the link with Quick Book is very good and it can be updated whenever you need to. With float downloading data directly from Quick Book that as also helped me to find mistakes which have been made in my accounts We have now spent a number of hours just updating our records in Quick Book which makes that set of records even better. This updated information is then uploaded back into float. I did have a demo version of two weeks but due to the virus this as been extended. I really feel that two weeks to have demo for this system is two short it needs to be at least 4 weeks, then you will start to see the benefits of using the system. I will not be going back to the old ways

Vorteile

The integration with Quick Books on line is very useful

Nachteile

I find the system to be very helpful in presenting the information you need but as yet I have not been able to understand the reports which it is generating. If you wish to print and send cash flow information to someone else you can but you can not have your company logo shown on the report but by default you can have the Float logo shown! The promo information says you can have this up and running within the day, which maybe you can but I don't think that I would want to reply on its data. It takes time to check the data is correct and even the if the correct information is recorded within Quick Books in the correct place. I have never used anything like this before and I found it hard work, the videos they have do show you how to do things but when you don't know what you need to do or what you need to know it take a little time to fully understand what and how to do it. The videos on you tube are helpful but when you are trying to understand what and how to do something I found the speed and the single tone of the lady talking was just way to fast and boring for a new starter to understand. When you understand a little more its still boring but you can understand better what she is now saying. In this time of covid 19 I feel the cash flow display is way to long its showing 20 months and I only want it to show 6, maybe it does it but I can find how to shorten it. At this time I have given up on the reporting section maybe I will come back to it later.

- Branche: Internet

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Big time and money saver - Daily cashflow particularly useful

We use Float every day and is the best Cash Flow software we tried when evaluating - it gets slow but regular updates and the support team are relatively responsive. It's not cheap but we feel the ROI is completely worth it.

Vorteile

Works great for short to medium term cashflow management and the integration with both Xero and FreeAgent is good. Easy to use and provides us with very intelligent data.

Nachteile

Takes a bit of management and doesn't always do everything you want - not so useful for long term cashflow projections but has become an invaluable tool for us. Small issues.

- Branche: Computer-Software

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Excellent tools for forecasting

We have for sure a forecast accurate

Vorteile

Easy to use, also gives you the chance to create scenarios and most important can predict the cash movement. You can even add companies

Nachteile

Its not multilanguage and multicurrency, you can add companies but cant be useful if having companies in different countries

- Branche: Buchhaltung

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Float cash flow is the easiest system one can use

Float cash flow is easy to use and understand and has made planning for our cashflow easy so I can recommend it to everyone.

Vorteile

Float cash flow is easy to use and understand as it isn't complex hence making planning for cashflow easier and the customer service is highly responsive

Nachteile

Other then being somehow expensive it is cheaper then doing calculations manually interms of time and accuracy

- Branche: Finanzdienstleistungen

- Unternehmensgröße: 10.000+ Mitarbeiter

- Wöchentlich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Simple software with amazing features

Vorteile

I mainly use Float for its forecasting or “what if” scenarios feature. Float is one of the software that offers this feature. It is a feature that most f of our clients looks forward to. Float can also integrate well with QuickBook and Xero, another accounting software my team and I use. The software together is seamless.

Nachteile

The inability to use more than one type of currency is a difficulty most of the times. But it is all tolerable, given the feature of the software.

- Branche: Informationstechnologie & -dienste

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Why wouldn't you?

I've loved it since I first got involved, over 3 years ago. I can't imagine life without it!

Vorteile

The ability to be Agile with my financial modelling, to allow me to make tactical decisions, without violating strategic objectives.

Nachteile

If I had to say, it would be price. The tool is probably of most use to SME's and the entry price point should be more like £20 / month

- Unternehmensgröße: 501–1.000 Mitarbeiter

- Wöchentlich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

easy to forecast based on your real data in Xero, scenarios allow testing of different events

able to see cashflow, which helps with investments and dividends

Vorteile

The sync with Xero means I don't need to worry about losing transactions, and can quickly compare forecast with actuals.

The scenarios tool enables me to examine whatif for any ledger/ sales or expense.

The weekly email tells you how much cash you have in the business too.

Nachteile

It's a little fun to setup, but you only have to do that once. Tweeking the budget is easy.

Perhaps an app.

- Branche: Buchhaltung

- Unternehmensgröße: Selbstständig

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Game Changing Cash Flow Forecasting Software

This has been a game changer in our practice, we can give daily, cash flow reporting updates to our clients during this Covid 19 Crisis.

Vorteile

I like how Float integrates seamlessly with Xero Accounting Software. It was relatively easy to set up for each client compared to other cash flow software apps on the market.

Nachteile

I dont have any dislikes at the moment with the software

- Branche: Buchhaltung

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

A really effective solution to assist businesses manage cashflow

Overall, I think Float is an excellent tool for cashflow forecasting and scenario planning. It is easy to use and understand and the support available from the team at Float is excellent.

Vorteile

Float is easy to use and not overly complex making it easy for clients to understand.

The integrations with accounting software such as Xero ensures it is kept up to date and makes cashflow planning a relatively quick and a regular task - which is key to managing finances.

The ability to forecast easily for different scenarios is a very useful feature that allows a business to easily see the impact of making changes.

Nachteile

It would be useful to have a multi currency feature

- Branche: Tiefbau

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Excellent Software

As an SME it has allowed us to get on top of our cashflow and is an invaluable tool.

Vorteile

It is very easy to use and integrates very well with Xero.

Nachteile

It would be good to allow:

- Scenario layers to be used as a base layer for a second scenario that is a variation of the first scenario.

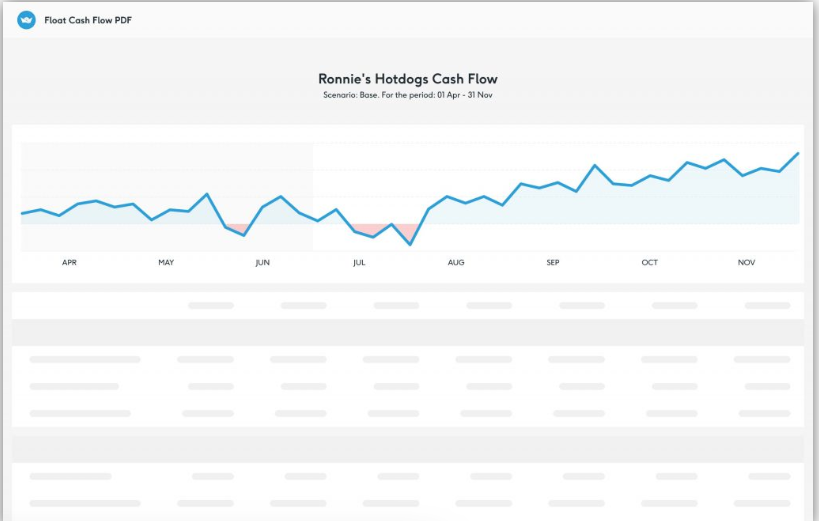

- PDF exports from the cash flow and daily breakdown pages that retain the page format.

- Branche: Schreiben & Editieren

- Unternehmensgröße: Selbstständig

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

'Super Easy'

Overall, it great, would recommend widely to use this program.

Vorteile

It saves time. As compare to forcasting with spreadsheets like old methods, float cash flow is very easy and time saver. it is an easy way to track cash flow. that's the software what i was looking for.

Nachteile

So far my experience with this program have been great, no negative things have seen.

- Branche: Informationstechnologie & -dienste

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Excellent Cash Forecasting Tool

Very good. The interface is generally easy to understand. The cash flow reports display is awesome

Vorteile

The integration directly with Xero. This allows us to see our cash flow forecasting move as soon as an invoice or bill is entered

Nachteile

Its a bit expensive but cheaper than the time needed to calculate manually. Adding new budget items is a little confusing

- Branche: Einzelhandel

- Unternehmensgröße: 10.000+ Mitarbeiter

- Monatlich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Simple and Task-Specific

Vorteile

Float focuses more on budget management and financial reporting. Our team uses it specifically for that. Because it is non-complex, it does not experience much lag time. It works fast and efficiently. Saves our team a lot of time rather than manually calculating budgets for supplies or manually creating financial reports. It is simple and helpful.

Nachteile

Supports one type of currency only. Although multi-currency is rarely done in our company, there are still exchanges that are multi-currency.

- Branche: Buchhaltung

- Unternehmensgröße: 2–10 Mitarbeiter

- Monatlich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Cheaper less powerful tool but gets the job done

Not for a more advanced complex company planning but for smaller businesses this can be a valuable tool to understand current and future cash flow.

Vorteile

Integrates well with Xero, our accounting software. You can create budgets and scenarios for different accounts from your GL. Very useful in that capacity but beyond that there is not much to the tool. Navigating around is not bad.

Nachteile

Historical graphs show actuals, not a great way to see variance. And forecast planning based on numbers not per headcount or any other fancier features. But for the price point this is a straightforward great tool.

- Branche: Marketing & Werbung

- Unternehmensgröße: Selbstständig

- Wöchentlich für 1-5 Monate genutzt

-

Quelle der Bewertung

This is one of the most useful tools we have

As the owner of a small business, having a 24/7 eye on our cash flow is THE most important aspect of running the business. It allows me to make decisions and also with the scenarios feature being able to model various scenarios and the impact on cash flow is incredibly powerful.

Vorteile

Once everything is synced up with your accounting software, Float gives a really quick and easy cash flow forecast when we need it. It's the kind of service I've wished existed for many years now.

Nachteile

I've found it a little confusing getting to grips with budgets vs actual forecasts... some aspects of the interface could be a little clearer. It's also a little frustrating being limited on editing the expense categories

- Branche: Buchhaltung

- Unternehmensgröße: Selbstständig

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Does what it says on the tin....

Vorteile

I came across Float at Xerocon 2019. I was actively seeking a cashflow App that was easy to set up, use and maintain. I had tried Apps that were more feature-rich but for my clients simplicity and easy of use was their priority. Float fits the bill. I have now been using it on a daily basis with clients for over 2 months and find it does a great job. The clients love it. I will be implementing Float as part of my essential App Stack - Hubdoc-Xero-Float.

Nachteile

So far I have had a positive experience with Float. If there was one area that I think further work can be done it would be the ability to mix scenarios to evaluate how they would affect future cashflows.

- Branche: Gastgewerbe

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Super Software

I love the customer service that made sure I understood what I was doing...

Vorteile

You feel more in control of your cashflow and your business hence.

Nachteile

It does a lot but can get complicated to understand. And for a small business like mine a bit too high price wise. But went for it anyway for all the pros.

- Branche: Erholungseinrichtungen & -dienstleistungen

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Float is incredibly helpful at a time in need

Vorteile

Float was really easy to set up and it took less than a day to get it all up and running. It integrated with Xero seamlessly and from the moment I signed up on the free trial I received access to a heap of helpful set up videos and access to useful webinars.

It is not time consuming to prepare multiple scenario's and I love the confidence I have in the accuracy of the projections due to it being integrated with Xero vs running off a spreadsheet.

Nachteile

Yet to find a function I don't like.

As a small not for profit organisation the price point is at the upper end for us but do appreciate the value of the product.

- Branche: Marketing & Werbung

- Unternehmensgröße: Selbstständig

- Wöchentlich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Great direct forecasting tool

- Keeps me sane, and saves me quite literally hours every week.

Vorteile

- Easy to set up and use

- Xero integration

- basic scenario planning

- Complex, but not complicated

- Uses direct method

Nachteile

- Could do with a good mobile view - the current one is very frustrating (I don't need an app, but a great mobile view would be high on my list)

- Branche: Computer-Software

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Great tool

Vorteile

This is a great tool to know my schedule, to know my co-workers schedule

Nachteile

There is nothing I don't like at this moment.

- Branche: Sportartikel

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Float Cash Flow Software

Overall I have found this software very helpful and also the customer service is really good. I always get a fast response and I love the fact that they are always looking to improve the software. The new function of multiple budgets in one cell was a bonus for our company.

Vorteile

What I like most about this software is how easy it is to use, even if you are not a professional accountant or bookkeeper. I also find the Scenario layers very helpful.

Nachteile

The one function I would love to have in Float is to be able to change the date of budget project to the next month without having to delete the budget in one month and enter to the next when our projects are prolonged to another month.

- Branche: Einzelhandel

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Review of Float cashflow forecasting

Cash flow reporting is more timely and accurate as is cashflow forecasting

Vorteile

Good layout, good features, simple to understand layout, flexible

Nachteile

Not able to enter formulas or percentage calculations when entering budget figures

- Branche: Informationstechnologie & -dienste

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für 1-5 Monate genutzt

-

Quelle der Bewertung

Cash flow analysis and Xero Integration

Our accountant recommended Float and provided the setup and training.

It took a few weeks to get comfortable enough to start adding groups ourselves for better analysis of costs and revenues. We attended a very good Webinar to help those new to Float and those still learning.

Overall we are very happy with the product and service. Well worth it.

Vorteile

Float seamlessly integrated into Xero so we could classify our chart of account codes into Groups and sub-groups for better analysis of cash in and out.

Focused our attention on realistic cash receipt dates.

Allow us to analyse past expenditures and set future dates for large annual outgoing expenses (no forgetting or surprises!!)

Nachteile

Its a small gripe but the sync scheduler could be more flexible (hourly v daily) for companies with a lot of transactions.

- Branche: Immobilien

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Useful tool

Vorteile

Ease of setting a forecast - makes it very easy to see in a format that is easy to read

Nachteile

Difficulty of editing fields & make accruals for future payments. Also, if you have over forecasted something, the difference rolls into the next month which is often not accurate.

- Branche: Marketing & Werbung

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für 1-5 Monate genutzt

-

Quelle der Bewertung

Great & Easy To Use Cashflow Solution

Float has really helped us to forecast the business health for the next few months (and even years), giving peace of mind and a plan of action to combat any revenue/cost scenarios on the horizon.

Vorteile

The integration with Xero was seamless, with lot's of helpful advice on how to get the best out of the cashflow projections.

Nachteile

Nothing of note as yet, the setup & forecasting has been really simple.

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

indispensable

Vorteile

We can overlay cash flows for ease of viewing upcoming months and forecasts of scenarios. with ability to edit

Nachteile

cannot really think of anything. As I cannot think of anything it is impracticable for me to put much else

- Branche: Möbel

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Better than sliced bread .....

Our relatively new business operation is experiencing exponential growth. Float gives us the ability to plan and tweak cashflow projections instantly and accurately with access to current and historical data seamlessly through the Xero integration.

Vorteile

Simplicity, functionality, Xero integration.

Nachteile

The nightmares it gives me over the years I spent trying to maintain cashflow data on cumbersome excel spreadsheets that were already out of date by the time I had updated them :(

- Branche: Buchhaltung

- Unternehmensgröße: 2–10 Mitarbeiter

- Monatlich für 1-5 Monate genutzt

-

Quelle der Bewertung

Cash Flow for Everyday People

Just starting to use this product and I like the clean (non-cluttered) layout of the screens. Easy to use, easy to setup and like the fact that you can readily track where the figures come from in xero.

Vorteile

User friendly and easy to understand. Logical layout for the everyday business person.

Nachteile

Would be could to pull in a 3 way budget if required . An upgraded version of the product.

Needs to integrate with myob, as this accounting platform is still used by a lot of larger construction companies who need cash flow advice.

- Wöchentlich für 1-5 Monate genutzt

-

Quelle der Bewertung

"Floating" with Float

Vorteile

Its very simple to understand, very friendly. It welcomes non financial users to use it. I've been using it for a couple of months and I feel very happy with it.

Nachteile

Sometimes it runs a bit slow and freezes. It wont let you handle more than one currency. It does not send alerts for expired invoices only for software updates.

- Täglich für 6-12 Monate genutzt

-

Quelle der Bewertung

Instrumental to our business.. excellent product

Vorteile

Fantastic for forecasting cashflow and it's integration with freeagent makes the experience seamless

Nachteile

Few features could be added which would make the details a little better, but know they're on the roadmap

- Branche: Informationstechnologie & -dienste

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für Mehr als 2 Jahre genutzt

-

Quelle der Bewertung

Business critical cashflow

Cashflow piece of mind

Vorteile

- amazingly simple to use

- instant accurate cashflow and runway

- so much better that the spreadsheets we used to use

- allows us to model different scenarios

Nachteile

There isn't much to dislike - it's a great bit of software

- Branche: Elektrische/elektronische Fertigung

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für Kostenlose Testversion genutzt

-

Quelle der Bewertung

Simple and easy to use

We can see exactly how we are tracking against out budget to make sure we are making money.

Vorteile

The timeline feature is all we need with forecasting. Other cashflow forecasting software I have tried looks good and has plenty of information but I have found Float to have the best forecasting.

Nachteile

I dont think it imports the Xero Budget.

- Branche: Automotive

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

EVERY business should use this - especially NOW

An excellent tool that gives me the ability to create realistic scenarios - especially the many required by the bank to back up a CBILS application

Vorteile

The ease of use once the extremely helpful support stepped in and dug me out of the very deep mess I had made!

Nachteile

I have not found any shortcomings or problems yet

- Branche: Transport/Güterfrachtverkehr/Schienenverkehr

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Float Cash Flow - Convenience at your finger-tips

There is nothing more convenient than float.

Vorteile

Float gives you a visualized look of how your cashflow will be like throughout the year.

Nachteile

Float gives you the option to play around with expected payment dates on your bills thereby giving you room to play around with your cash flow.

- Wöchentlich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Easy to use, very intuitive

Vorteile

Overall simplicity and ability to seamlessly sync with our other business software such as Xero. Well priced as well.

Nachteile

Nothing - it's pretty great. Any glitches are addressed or explained by the helpdesk team who reasons quickly.

- Branche: Buchhaltung

- Unternehmensgröße: 2–10 Mitarbeiter

- Wöchentlich für 1-5 Monate genutzt

-

Quelle der Bewertung

Perfect Business Cash Forecasting Tool

Vorteile

The sync with accounting software is effortless.

Updating is a breeze.

Nachteile

Limited additional user controls/ permission limitations.

- Branche: Computer-Software

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Float is just great

Vorteile

We used Excel for predicting our forecast cashflow. It was very time consuming to maintain this system. Float integrated with our bookkeeping software, Xero, made cashflow forecasting very easy!

Excel-like functionality in the browser makes editing easy. The single-page view for an overview is great.

Nachteile

No Excel-like bulk-edit for scenarios except base!

- Branche: Buchhaltung

- Unternehmensgröße: Selbstständig

- Wöchentlich für Mehr als 1 Jahr genutzt

-

Quelle der Bewertung

Float

Vorteile

Ease of use

Direct integration with accounting and bookkeeping software!

Nachteile

Slightly expensive for basic or start-up businesses - perhaps a reduced functionality package that's a bit more affordable?

- Branche: Essen & Trinken

- Unternehmensgröße: 2–10 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Float Review

Vorteile

Visualizing the cashflow of the business and the integration with Xero

Nachteile

The only negative so far is the Monthly cost, it is expensive

- Branche: Marketing & Werbung

- Unternehmensgröße: 11–50 Mitarbeiter

- Täglich für 1-5 Monate genutzt

-

Quelle der Bewertung

Great, clear app

Vorteile

Float is easy to use and provides practical and simple information that enables us to really plan our cashflow - it takes away a huge pain point of Xero.

Nachteile

Float takes some getting used to as there's not a complete integration out of the box, and requires some customisation to remove certain non-cashflow related expenses.

Ähnliche Kategorien

- Dashboard Software

- Absatzplanung Software

- Budgeting Software

- Buchhaltungssoftware für Wirtschaftsprüfer

- Buchhaltungssoftware für Banken

- Buchhaltungssoftware für Architekten

- Online-Buchhaltungssoftware

- Buchhaltungssoftware für Kleinunternehmer

- Financial Reporting Software

- Rechnungsprogramme für Kleinunternehmer